UPI makes you spend a lot!

It is amazing that even people from the countries that call themselves first-world countries get pleasantly surprised by experiencing the payment infrastructure we have here in India. Mostly by UPI.

You can pay for everything from an Eclairs chocolate to an OLA ride just by using your phone! It is magical but not magic.

I loved it on the first go. But there are some behavioural issues that tag along with it as well.

Just Scan!

Payments Made Simple: I still remember how UPI helped us during COVID. I did not have to go to the bank or line up in front of ATMs or get things on debt. Just scan the QR and pay directly from your bank account.

This felt surreal at first. Eventually it came to a point where you can just drive a parked bike just by an app and pay it by UPI.

Recalling how Congress minister P. Chidambaram poured scorn on India's ability to adapt to digital payments!! pic.twitter.com/j56P9exAAC

— Shan Kamaraj (@skamaraj32) January 2, 2023

When I wrote about how to save money in India, I did not mention how UPI can make you spend more just because it is so easy to use. It should also be featured on How Ease-of-Life Hurts?.

It literally is an example for the saying there is an app for that.

- Phone and QR Code: Whether it’s paying at a shop, splitting a bill at a restaurant, or transferring money to a friend, UPI has made financial transactions incredibly straightforward. All you need is your phone and a QR code, which has become as common as the shop signboards.

Safety First: There was a time when I used to keep a wad of cash in my wallet, always vigilant about pickpockets, especially in crowded places like markets or in BMTC buses. UPI has eliminated that fear. Now, I don’t have a physical wallet.

No Chocolates as Change: How many times have you received chocolates as the shopkeeper has no change for ₹1 or ₹2. No more! Pay the exact amount, even in paisa.

Global Ambitions: Recently, I read about BRICS countries adopting UPI. It’s thrilling to think that this system, which I’ve grown to rely on daily, might soon be a global standard. Imagine paying in Moscow or Cape Town with the same ease as in Benagluru!

If You’re not Watchful, You lose money

However, like any technology, UPI isn’t without its downsides:

- The Loss of Physical Money’s Feeling: There’s something about handing over cash. The act itself can remind you of the value of money. With UPI, I’ve noticed a disconnect; money seems less real, and spending becomes more abstract. Sometimes, this leads to a lack of financial discipline.

These days I don’t mind paying ₹2000 for groceries in supermarkets. Before, I used to be hisitant to pay ₹5 extra for a different kind of sona-masuri rice.

Unnecessary Online Purchases: The convenience of UPI has also made online shopping incredibly easy. There have been numerous occasions where I’ve bought items online just because it was so simple to pay, only to realize later that I didn’t really need them. This ease can foster impulsive buying behavior.

Scams and Security: Despite its benefits, UPI has not been immune to scams. I’ve heard of friends receiving fake calls or messages pretending to be from the bank, asking for OTP, personal details or to make a ‘test transaction’. It’s a constant learning curve to stay one step ahead of these fraudsters.

Living with UPI has transformed my daily life in ways I couldn’t have imagined. The convenience it brings is unparalleled, making financial transactions not just easier but also safer and more inclusive.

How I use UPI?

I do not see people carrying cash these days. This helps in not getting pickpocketed in crowded places.

Nowadays everyone is using UPI and no one can guess that you are still carrying cash. This is useful. UPI users have left enough change(coins) for others to use.

No Internet on my Phone

I just let my data plan expire on my phone. I did not recharge with any data.

Now TRAI has also forced telecom companies to offer call only, SMS only, data only recharge plans which is quite useful in my case.

This was a radical move but it has saved me a lot of money.

I do have UPI but, without internet it is useless. At home I have WiFi though which I can still use UPI to pay all the necessary bills, SIP orders, phone recharges etc.

When I’m outside, there is no internet for my phone. I have to use hard cash. This friction itself has made me spend less everywhere.

But you can be one of those people who use a lot of e-commerce apps to buy things. I’ve a perfect way to save money for you.

I Carry Cash

Whenever I buy something, I have to give enough cash. They give me the item along with the change. This makes me feel I lost something. This feeling was enough to be mindful about my expenses.

I have to plan the day before leaving & carry enough cash to buy things I need(not want)

Have you ever been to a supermarket to buy just a soap and come out with two bags of items?

This implulse buying is not happening with me anymore. I take only the cash I need to buy the pre-listed items. Nothing more.

These days ATMs are pretty empty. I can get cash whenever I want. It wasn’t the case before. There used to be queues (at least in Bengaluru) but not anymore.

If a situation comes where I have to buy something and I do not have any money then I will ask someone(or recharge shop) to recharge my number for data(say ₹30 one day data plan) to complete the transaction. But it hasn’t happened so far.

I have mentioned some other ways to save money in India

I’m in the Present

A side-effect of not having internet on the phone is that I’m aware at all situations outside. It was actually the Internet that was keeping me glued to the phone screen.

When I’m with people around, I have to talk to them. There is no escape. As an introvert this is something I don’t do by instinct but it has been helpful in overcoming my habits of being by myself all the time.

Can you do it?

NO!

Most of you cannot do it.

This is a very inconvenient way to make payments in the present day. But if you have madeup your mind to save money then yes, this is an alternative way to keep yourself mindful of your money.

I’m happy that UPI is going global. I’m happy to use it in another country someday soon. But I have to make enough money before going on international vaccations 🙃

Credit Cards are Useful

Here is an alternative method if you do not want to carry cash.

As much as it is hated by a section of people, I think Credit Cards are quite useful. I have bought many inexpensive things just using reward points.

Rupay credit cards are even more useful because you can use them with your UPI apps. You do not have to carry that card for day to day usage.

Credit card can be your emergency fund. I usually, do not keep more than ₹50,000 cash in my bank account. Since the credit card limit is around ₹1,50,000, I do have a buffer in case of emergency.

Your money can earn in investments while you spend using credit cards. You get reward points from CC, interest on your money from bank, returns from your investments. It seems all win-win.

There is a catch. All your data of what you spend your money on and how you spend your money will be with the credit card company.

They will know how to make you buy things. Tata Neu intelligently integrated their online shop and credit card together so as to market their platforms like chroma, big basket, titan etc.

Credit Cards track your money habits!

Now, that being said you can set a soft limit on how much you can spend in a billing period.

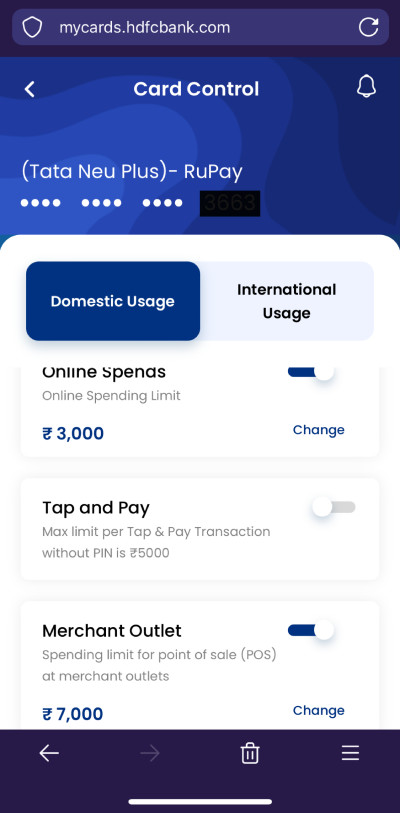

In my case it was mycards website but in your case it may be found in netbanking website or dedicated credit card app.

Here is what you do. Set limits as shown below. You will not be allowed to spend more than that limit. You will see an error on UPI app if you try to spend more.

This settings is easy to change. You just have to login using OTP but there still is a small friction. You should remove the limits only do this in case of an emergency.

Subscribe to future articles

No spam, once a month email.