How to Save Money in India?

As someone who has always been passionate about saving and being financially responsible, I wanted to share my personal experience of how I was able to build a healthy savings account while living in India.

It hasn’t always been easy, but with a few lifestyle changes and a strong commitment to my financial goals, I’m proud to say that I’m well on my way to achieving the financial freedom I’ve always dreamed of.

Do not watch TV/Insta Reels/Shorts

As much as you’d like to swipe endlessly on these amazing, entertaining reels, they are subtly asking you to either buy something or that you are misising out on things.

Somone has just been to Bali and their reel has an inpiring background music. This makes you think you should go there too.

These people are using the latest iPhones to shoot these amazing videos. You’d like to buy one too.

Someone tells you how their life has changed because they are wearing this digital watch and you think your life might change as well if you buy that watch.

A guy sips ₹500 coffee from a cup with his name on it, and you feel that’s the kind of drink you should be having.

Be a horse with blinders on!

You should do these things at some point but not because you want to show it to someone. There is a difference.

Yes. You should go to Bali(what an amazing place) but not because you want to show someone but because genuinely you want to experience that place.

I’ve been to amazing places and clicked zero photos sometimes. Because I do not want to show-off.

When you reach a stage where you do these expensive things but you are doing it for the fun of it and not to show it to someone then consider yourself rich.

OTTs Eat Small Money Regularly

At a stage where you have already achieved Financial Freedom, you will not think of these expenses as expenses at all.

But when you are still trying to achieve it, I suggest you to refrain from Over-The-Top services. More than money, it eats up your time and attention.

OTTs are a little more convenient than torrents. I chose the less convinient way.

Sometimes you have to be a Pirate!

I just download movies to my iPhone and AirPlay it to the TV or screen-mirror the phone and play the movie on VLC.

If you do now how to pirate, there are video guides. A little carefulness helps getting the right content and not compromising your system.

I used to spend too much on movies. Multiplexes have decent ticket price but sell food at 100x. I can’t imagine buying a popcorn for ₹300 even today.

I stopped watching movies on theaters. I just waited for a month or two for the movie to be released on some OTT. If it is on OTT then you can get it even without subscribing but it is - as I said before - less convenient.

Cook to Survive

Our ancestors used to eat once or twice a week. Now, if we skip a meal, we get gastritis.

A good habit for the modern man would be to eat once a day. It is also called OMAD. It will take a lot of will power to do this but once you stick to it long enough then you don’t have to worry about cravings.

When I first moved to Bengaluru for work, I’ll admit, I was pretty overwhelmed by all the food options available. It was so tempting to just order something through swiggy, zomato or eat out every day.

Though these options came later in my career, it was always easy to go out and eat something tasty.

However, I quickly realized that this habit was burning a huge hole in my pocket.

Not just that, the food we get outside is so adulterated that you wouldn’t believe. Read food we eat is poisonous.

That’s when I decided to teach myself how to cook a few simple, yet delicious Indian staples like dal-chawal, rice bath, and lemon rice.

I watch cooking videos on Youtube now and then to learn new recipes. Youtube helped me even on things like number of ways to cut an onion.

At first, it was a bit of a struggle, but I found a bunch of easy-to-follow recipes online and started experimenting in the kitchen. The results were not only wallet-friendly, but also much healthier than the greasy, oily food I was used to ordering.

I remember the first time I made a perfect batch of dal-chawal - I was so proud of myself, and the sense of accomplishment was unbeatable. Slowly but surely, I began to enjoy the process of cooking and even started finding it therapeutic.

Food doesn’t have to be Delicious!

But it should nourish your body with nutrients.

If you realize this one truth, you will never look at food the same way.

If I were to start-over again, I would first learn how to make Ganji(porridge) with rice/flour. It just takes 2 ingredients, rice and salt to taste. It is a good start and you cannot go wrong with it if you are fine with constant stirring.

I would move to Upma next because it is quite similar but has more ingredients and tastes better. A very similar dish is Lemon rice which is quite easy to prepare if you already have left-over rice. I like Puliyogare a lot because I think of it as the South-Indian fast-food. So easy to make and tastes so good.

Now, these are entirely carb and not good for the body. Eventually, I would like to cook with legumes, grams, veggies to it so that it will have enough protein and fiber. A dish I recommend is Pulav which has pretty much everything. A perfect dish for OMAD.

Occassionally, eat eggs and meat if you are a meat eater. Cooking something tasty with meat is easier compared to vegetables but keep everything in moderation.

Some days I would just fast. I do not eat anything the entire day except for water. This helps cleaning up the digestive track.

If you have any stomach related ailments, try fasting. I was never able to fast for more than 2 days but I wish I could. It will switch the body to autophagy which is a topic for another article but I feel being is autophagy is the best medicine there is.

Non-Branded is Not Bad

Growing up, I was always surrounded by friends and family who seemed to have the latest fashion trends and gadgets. It was easy to feel like I needed to keep up with the Joneses.

However, after doing some serious reflection, I realized that this mindset was only holding me back from my financial goals.

I made the conscious decision to steer clear of branded clothes and opt for high-quality, non-branded alternatives instead.

To my surprise, I found that there were so many great options out there that were not only affordable but also incredibly comfortable and long-lasting.

Don’t be someone else’s poster boy.

Unlike Zuckerburg who had a closet full one single colored T-shirt, I have 4 of them. They are mostly used while I go outside for a walk, to play or to shop.

I have two shirts for functions or events. I have a black and blue jeans pants. These cover most of my clothing already.

Most times, unknown brands will have good cloth but the stitches are sub-standard. You just have to stitch it up once it comes off.

Since I have been working from home, I do not need those many clothes. I gave up all my formal clothes to a relative of mine who just started his career.

I do buy expensive innerwears which I think is essenstial in hot countries like India. I find Damensch to be pretty comfortable to wear in hot summers.

Usually a single underwear costs ₹300-₹500 but it is worth it. You just need half a dozen of these and you are set for at least 4 years.

Be a Minimalist

One of the biggest game-changers for me was embracing a minimalist lifestyle. When I first moved to the city, I’ll admit, I got caught up in the consumerist culture and ended up accumulating way more stuff than I needed.

But then I realized that all those material possessions were not only taking up valuable space, but also draining my savings.

I made the decision to downsize and only keep the essentials. No more fancy gadgets or the latest model of a car. Instead, I opted for my dads old car and a basic, functional phone.

Buy a Macbook(at leat M1 processor) instead of a desktop that occupies a lot of space. These M series machines can take heavy workload without breaking a sweat.

I have 3 broken laptops(which are worth pretty much nothing), 1 working laptop and a huge desktop now. I wish I had known better and bought a Macbook earlier.

This might seem expensive but I can tell you it is worth every rupee. You can even buy a refurbished one at a lower price if you want to save more money and do not mind used stuff.

We don’t have a refrigerator. We get all the veggies, leaves, groceriea, and meat on-demand. We don’t store it since we get it two, three times a week.

I wish I had no TV. We did manage without a TV for 3 years before the first kid. But after that we had to give in. We have a 24inch TV without much options of OTT though.

It was a bit of an adjustment at first, but I soon realized that I didn’t miss any of those things. In fact, I felt a sense of lightness and freedom that I had never experienced before.

Buy a Bicycle

I cannot stress this enough. We should learn from the Dutch people. Netherland is full of bicycles. Roads are built around cycling culture.

Buy a good, used bicycle which has gears(useful to climb) and a career. Use platforms like OLX to look for used bicycles around your area.

It is a perfect cardio for loosing weight. Read Do not Exercise.

You want to buy groceries, use your bicycle. You want to get milk, use your bicycle. You have to go to any place (under 5kms) alone, just use your bicycle.

Bicycles do not ask for gas. Compared to auto-rickshaws these are low speed, takes up less space, safer if you have riding etiquets. Read Do you really need a car?

I have been using it for a while now and I feel that everyone should be using a bicycle. I do not see that happening in India.

I barely take out my car unless others have to go somewhere. In a city like Bengaluru, you can beat the traffic jams with a bicycle.

I don’t care if it gets scratched or breaks down. I can just put the chains back on. Major service will cost a maximum of ₹1000! Parking is the easiest part.

Everyone I see around here has a bulged tummy. They use a bike, scooter, or a car to even buy dhaniya. Get a bicycle. It will improve your health and bank balance.

Staying Healthy on a Budget

As someone who loves to stay active, I’ll admit that it can be tempting to splurge on expensive hobbies and memberships. But I just made friends with the kids in the colony and play with them. Sometimes we play shuttlecock, sometimes cricket. Zero cost but all the benefits.

I don’t go to bakeries. We don’t buy biscuits, cakes, or anything that has sugars, maida, oils, and other halmful chemicals. My wife sometimes bakes cake. I make chikkis, banana chips for my kid.

Initially he used throw tantrums for chocolates or ice-creams. Once he realized that he is not going to get any of those, he eventually stopped asking.

This keeps all of us healthy. Sometimes we do feel like eating some sweets from outside. On such days I buy them coconut water or get something from Nandini store. Things like Mysore Pak, Dood Peda, Besan Laddoo are all made with Ghee, milk solids, besan, in Nandini.

Drinking & smoking was never my thing. I suggest you to gradually come out of these habits as well. It helps not just in saving money but also saving your health.

It has saved not only on our medical bills but also the direct spending on these things.

It may be difficult at first but I suggest you to make an effort to get everyone in the family on-board with proper reasoning instead of just setting the hard rules.

Spend Money Created by Money

Imagine you have a job that earns you ₹30,000 a month. Let’s say, after expenses you are left with ₹10,000.

You’d want to spend this money on something you like, say, a new gadget, jeans, a trip, what have you. But you shouldn’t!

You can only spend ₹60. Not now, the next month. If you want a jeans of ₹600, you will have to wait 10 months.

That sounds crazy but what is the logic here?

If what you want to buy is a want (not a need) then you should not buy it from your direct earnings.

You should always try to buy it from the interests(profits) through your investments.

It may delay your purchase but it will be worth it.

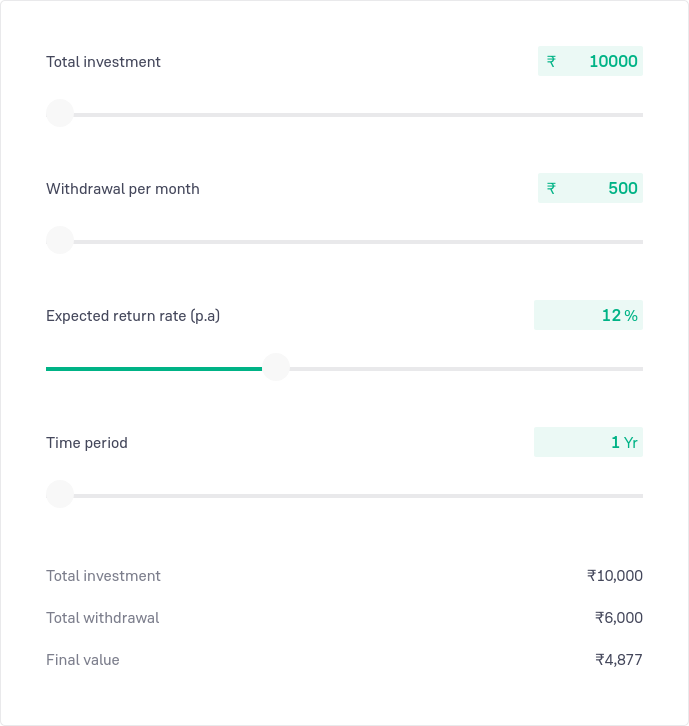

Invest the ₹10,000 in some instrument(MF, STOCKS). If you invest it today, assuming 12% returns per year, you can spend only ₹500 next month.

The next month your spending capacity increases to ₹1000. You can spend ₹6000 by the end of an year. This way you will not be depleting your investments.

At a certain time it will reach a point where you can buy pretty much anything you want.

It may not make sense now but eventually you will realize that’s how your expenses on wants should be.

The calculations shown above is entirely my opinion. The numbers are conservative but you can decide a number by changing the parameters.

Patience and the Path to Financial Freedom

One of the biggest lessons I’ve learned on my journey to financial freedom is the importance of patience and delayed gratification. It’s easy to get caught up in the instant gratification of splurging on the latest gadget or a fancy trip.

But I’ve come to realize that true financial security comes from consistently saving and investing over the long term.

And in the meantime, I’m focusing on building up my savings and investments, so that when the time comes, I’ll be able tospend on those. I can achieve big milestones with confidence and financial security.

Overall, my journey to financial freedom in India has been a challenging but incredibly rewarding one.

By making small, incremental changes to my lifestyle and mindset, I’ve been able to build a healthy savings & investments and put myself on the path to the financial independence I’ve always dreamed of.

And I hope that by sharing my story, I can inspire others to take that first step towards their own financial freedom.

Also read How to Achieve Financial Freedom in India?

Subscribe to future articles

No spam, once a month email.