Should I Buy or Rent a House in India?

Building a house in India has always been viewed as a traditional and somewhat secure way to park one’s money, promising both rental income and potential appreciation in land value.

My opinions are on the current state of affairs. It might change in the future.

But is it really the golden goose many make it out to be? Here, I’ll share my journey into understanding and navigating the Indian real estate market, and why I’ve come to question its touted benefits.

The Attraction of Real Estate

When I started contemplating investment options, real estate was one of the first things that came to mind. The stories of land prices skyrocketing in cities like Mumbai, Bengaluru, and Delhi are legendary.

Even in smaller towns and remote villages, the price of barren land has surged due to increasing demand for space, thanks to India’s preference for horizontal expansion rather than vertical.

Indians build Horizontally.

You do not see a lot of skycrapers in India. This could be a civilizational thing. Skycrapers are not instictively deemed safe by Indians.

Also, FSI(Floor Space Index = How tall you can build) in India is quite low. If this were to be increased by the government then you will see more skycrapers mushrooming in cities like Mumbai, Bengaluru etc.

This will drive the real-estate demand low thus decreasing the price for land, building, and also rent.

I wish this changes with time because we do lack space and with the population growing at a rapid pace, we can use some vertical space.

This lack of space leads to a demand that cannot be met. The prices for land explodes.

I have friends who invest only in real-estate and rent out buildings. I don’t blame them but I think they are doing what they know best.

At least these buildings won’t collapse in a day(unless there is an earthquake) like the stock market. Also, the land value usually remains at a higher end.

Living with your parents is Wise

If you have to move to a new place to work then it is understandable that you cannnot stay with your parents.

Might get me canceled but:

— Aryan Kochhar (@aryan_kochhar) January 5, 2025

Living with parents in your mid 20s isn’t a ‘failure’—it’s financial wisdom in a world where rent eats 50% of your income. But hey, keep chasing ‘independence’ while you’re broke, lonely, and eating ramen for dinner. Choose your struggles wisely.

But if you can, live with your parents. That saves a lot of money and mental stress.

Your kids will have someone at home to take care of them.

Never mind what the society says. Maybe build a bigger house so that it isn’t crammed.

Wives are pushy

My wife always asks me to get a place for ourselves. Well, that is a great idea but not practical at the moment.

Imagine I buy a 30x40 square foot land and do build a house for around ₹50 Lakhs, I will be paying an EMI of ₹40,000.

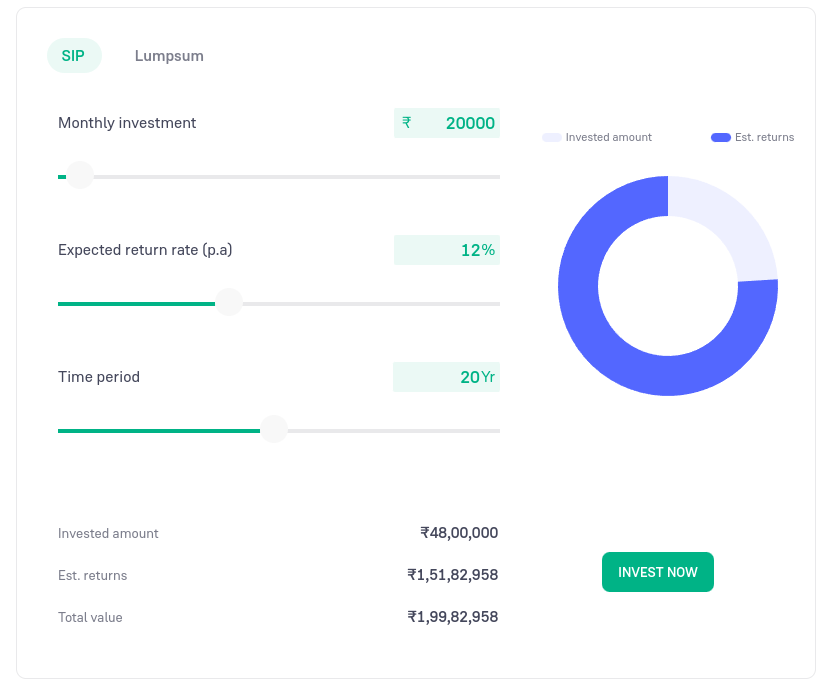

What is the point of this, when I can comfortably stay at a bigger house for ₹20,000 rent and put the other ₹20,000 as SIP in a low-risk mutual fund.

The peace of mind a debt-free life gives is priceless!

After 20 years, the SIP will be worth ₹2 Crores - considering 12% yearly returns - with which I can retire for life instead of still working my as off to pay the housing loan.

The Demand-Supply Imbalance

- Population Growth: India’s population has surpassed China, and with it, the need for housing, commercial spaces, and infrastructure is growing at a rapid pace.

- Urbanization: People are moving to cities in droves for better employment opportunities, education, and lifestyle, which naturally inflates the demand for property.

- Land Scarcity: Land is a finite resource. Unlike stocks or bonds, you can’t produce more land, which inherently makes it more valuable over time, especially in areas where development is anticipated.

The Real Cost of Real Estate

But let’s get into the nitty-gritty. Here’s what I found:

Initial Investment and Costs

I started looking at buying at least an acre of land, influenced by the idea of self-sustainability through permaculture. Here’s a breakdown:

- Land Acquisition: Even in less sought-after rural areas, buying an acre could set you back by ₹10-15 lakhs, and this is just the barren land.

- Development Costs: If you’re thinking of building something, whether it’s a house, a commercial building, or even just setting up agricultural land, the costs can escalate quickly. For instance, building a modest house might cost you around ₹30 Lakhs.

Passive Income from Investments

I had a plan of owning a rental property that would provide me with a steady income stream. Here’s how that plays out:

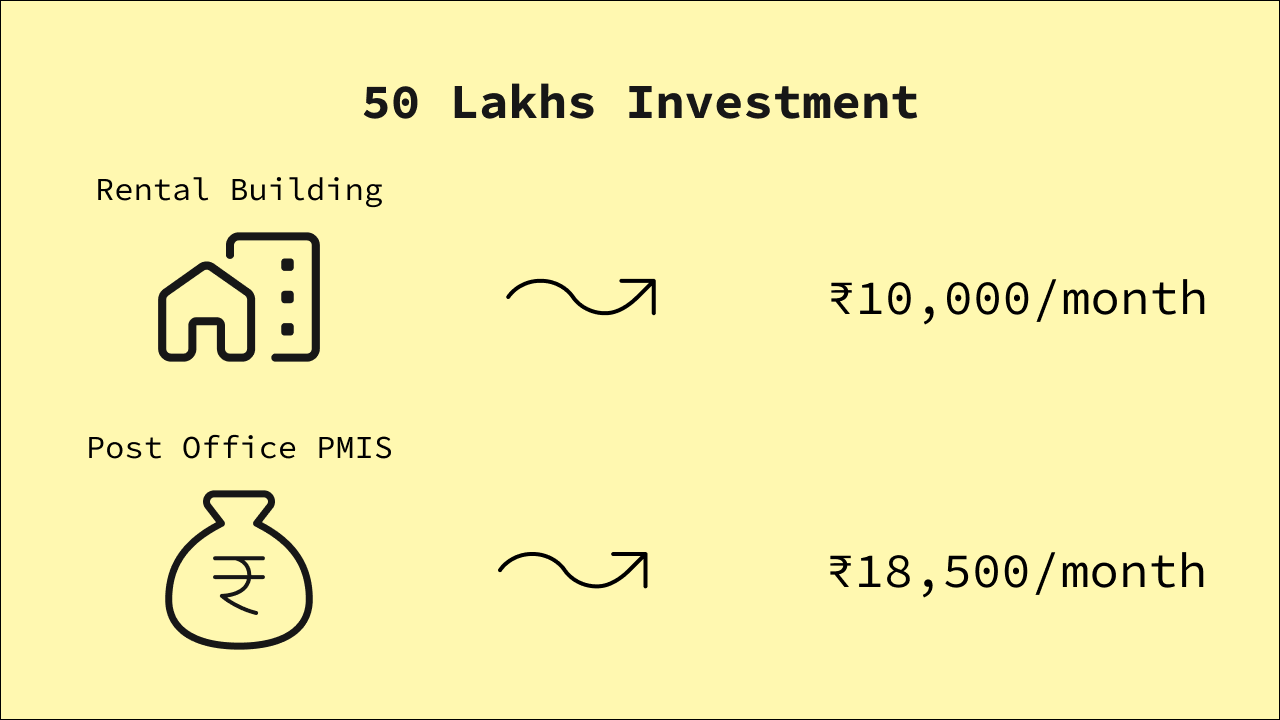

- Rental Yield: Suppose I build a house for ₹30 Lakhs. If I manage to rent it out for ₹10,000 per month, that’s ₹1.2 Lakhs a year, which seems decent. But:

- Maintenance: I’ll need to maintain the property, which includes repairs, painting, and ensuring all amenities like plumbing and electricity are functional.

- Tenant Management: Finding good tenants who pay on time is a hassle in itself. Plus, there’s the risk of property damage or legal issues if things go south.

- Vacancy: There will be times when the property might be vacant, which means no income during those periods.

When compared to fixed income schemes like the Postal Monthly Income Scheme (PMIS) which offers 7.4% returns, your ₹30 Lakhs would fetch you ₹18,500 monthly, almost double of what you might get from rent, and without the headache of property management.

You can further increase this returns on a little more riskier instrument - The Stock Market. It has historically given at least 12% returns.That would be ₹30,000 per month for ₹30 Lakhs!

I have written a detailed post on How to Invest in the Stock Market. That will give you a detailed explaination on what to expect from the Stock Market.

Real Estate Cannot be Converted into Cash that Easily

One of the stark realizations for me was the liquidity aspect:

- Selling Real Estate: Land or property isn’t like stocks or mutual funds; you can’t sell it off at a moment’s notice. The process is lengthy, involving legalities, finding a buyer, and often settling for less than your expected price in urgency.

- Emergency Funds: If you need money quickly due to unforeseen circumstances, real estate is not your ally. It’s not easily liquidatable, which could be a significant drawback.

Appreciation vs. Depreciation

While it’s true that land values in India have historically appreciated:

- Location Matters: Not all land appreciates at the same rate. Location is king, and if you buy in an area with no growth prospects, you might not see the expected rise in value.

- Market Cycles: What goes around, comes around. Real estate markets go through cycles. The rapid growth we’ve seen could slow down or even decline, especially if economic conditions change or if there’s a policy shift regarding real estate. This has not happened in India yet but cannot rule it out.

There are Better Options than Real Estate

Given these insights, I started exploring alternatives:

- Senior Citizen Schemes: These offer a higher interest of around 8.5% which is quite good if you can make a deal with your old parents.

- Fixed Income: Schemes like PMIS or bank fixed deposits offer predictable returns with zero maintenance.

- Gold: Often considered a hedge against inflation and relatively liquid compared to real estate. I recommend Sovereign Gold Bond instead but government seem to have stopped issuing it.

- Equity Markets: While riskier, they provide liquidity and potentially higher returns over the long term.

A great example would be to park your lumpsum money in an ETF like Nitftybees and creating an SWP to get regular income out of it.

You can do this on mutual funds as well but the above example saves some fees levied by mutual funds.

Jon Jandai’s Ted Talk is For You

Life is easy according to Jon Jandai. He also proposes that like a bird, humans should be able to build their own home without other’s help with the resources available around us.

We make our life hard by trying hard. We can grow food, build mud houses, treat common illnesses, and rest more than we work.

I Go Wherever I Want

If you buy a house to stay in it, then you are pinned to a location. This location maybe is good or bad.

Let’s say you bought a house in Delhi. One day you realize that the Air Quality Index(AQI) of Delhi is past 1000 which should be below 50, and you want to move to Kotdwar where you belong to. What do you do with the house in Delhi?

Give it to rent? Who will manage it time-to-time? What if the tenants ruin the place? If there is a leakage in the bathroom tap, who will fix it for you? Will travel all the way to Delhi for a tap?

Do you sell it? Will you find buyers at the price you are quoting? You might sell it but what’s the point? You shouldn’t have bought it in the first place.

I like the freedom to travel anywhere I want and make it my home.

I don’t want to worry about that one home I own where I have a Neem plant which needs to be watered on alternative days.

You will be tethered if you own a place. Just take a place on rent. You never have to worry about the maintenance.

Personal Reflection

After weighing all these factors:

- Financial Security: I’ve found that having easily liquidatable assets gives me more security than owning a piece of land I might struggle to sell in need.

- Sustainability: While the idea of growing my own food on an acre was romantic, the practicalities and initial investment made it less appealing than I initially thought.

Real estate investment in India isn’t the slam dunk many believe it to be. Yes, it has its merits, particularly in terms of potential appreciation and the emotional satisfaction of owning land.

I also suspect there is a lot of black money that is driving these high prices. If there is a surgical-strike on this black money then the prices will come down substantially. This is why politicians own a lot of land.

However, it comes with its own set of challenges - from high initial costs, maintenance, liquidity issues, to the unpredictability of tenant income.

For someone like me, who values simplicity, liquidity, and peace of mind, the traditional attraction of real estate has dimmed.

But my Mom still wants me to build a house for myself.

Instead, a diversified portfolio with a mix of fixed income, equities, and perhaps a small portion in real estate for diversification might be a more balanced approach to wealth building in the Indian context.

Remember, investment decisions should not just be about potential returns but also about how these investments fit into your life, your financial goals, and your peace of mind.

Subscribe to future articles

No spam, once a month email.